Users and manufacturers can apply the insights developed in this book to improve their innovation processes. In this chapter, I illustrate by showing how firms can profit by systematically searching for innovations developed by lead users. I first explain how this can be done. I then present findings of a study conducted at 3M to assess the effectiveness of lead user idea-generation techniques. Finally, I briefly review other studies reporting systematic searches for lead users by manufacturers, and the results obtained.

Searching for Lead Users

Product-development processes traditionally used by manufacturers start with market researchers who study customers in their target markets to learn about unsatisfied needs. Next, the need information they uncover is transferred to in-house product developers who are charged with developing a responsive product. In other words, the approach is to find a user need and to fill it by means of in-house product development.

These traditional processes cannot easily be adapted to systematic searching for lead user innovations. The focus on target-market customers means that lead users are regarded as outliers of no interest. Also, traditional market-research analyses focus on collecting and analyzing need information and not on possible solutions that users may have developed. For example, if a user says “I have developed this new product to make task X more convenient,” market-research analyses typically will note that more convenience is wanted but not record the user-developed solution. After all, product development is the province of in-house engineers!

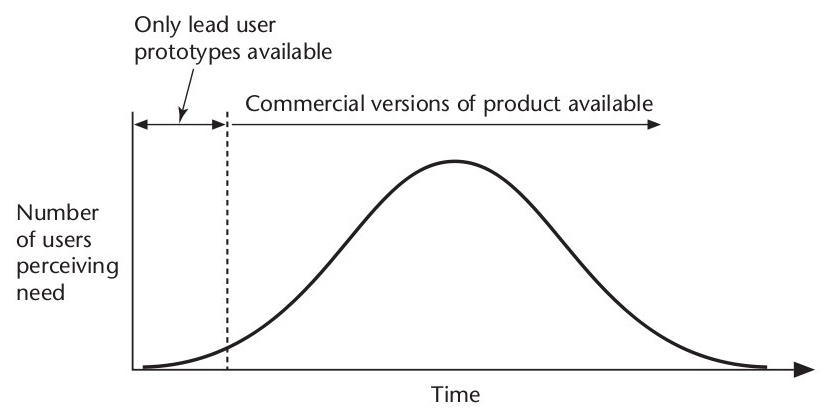

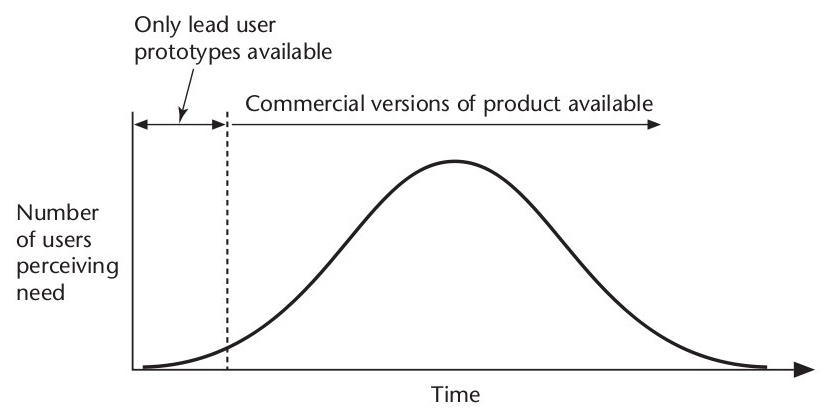

We are therefore left with a question: How can manufacturers build a product-development process that systematically searches for and evaluates lead user-generated innovations? (See figure 10.1.) It turns out that the answer differs depending on whether the lead users sought are at the leading edge of “advanced analog” fields or at the leading edge of target markets. Searching for the former is more difficult, but experience shows that the user-developed innovations that are most radical (and profitable) relative to conventional thinking often come from lead users in “advanced analog” fields.

Figure 10.1 Innovations by lead users precede equivalent commercial products.

Identifying Lead Users in Advanced Analog Fields

Lead users in advanced analog fields experience needs that are related to but more extreme than those being faced by any users, including lead users, within the target market. They also often face a different set of constraints than those affecting users in the target market. These differences can force them to develop solutions that are entirely new from the perspective of the target market.

As an example, consider the relationship between the braking requirements faced by users of automobiles (let's call auto users the target market) and the braking requirements faced by large commercial airplanes as they land on an airport runway (the advanced analog market). Clearly, the braking demands on large airplanes are much more extreme. Airplanes are much heavier than autos and land at higher speeds: their brakes must rapidly dissipate hundreds of times more energy to bring the vehicle to a stop. Also, the situational constraints are different. For example, auto drivers are often assisted in braking in winter by the application of salt or sand to icy roads. These aids cannot be applied in the case of aircraft: salt would damage aircraft bodies, and sand would be inhaled into jet engines and damage them.

The result of the more extreme demands and additional constraints placed on solutions to aircraft braking was the development of antilock braking systems (ABS) for aircraft. Auto firms conducting searches for valuable lead user innovations regarding auto braking were able to learn about this out-of-field innovation and adapt if for use in autos---where it is common today. Before the development of ABS for autos, an automobile firm could have learned about the underlying concept by studying the practices of users with a strong need for controlling skidding while braking such as stock car auto racing teams. These lead users had learned to manually “pump” their brakes to help control this problem. However, auto company engineers were able to learn much more by studying the automated solutions developed in the “advanced analog” field of aerospace.

Finding lead users in advanced analog markets can be difficult because discovering the relevance of a particular analog can itself be a creative act. One approach that has proven effective is to ask the more easily identified lead users in target markets for nominations. These lead users tend to know about useful advanced analogs, because they have been struggling with their leading-edge problems for a long time, and often have searched beyond the target market for information.

Networking from innovators to more advanced innovators in this way is called pyramiding (von Hippel, Thomke, and Sonnack 1999). Pyramiding is a modified version of the “snowballing” technique sometimes used by sociologists to identify members of a group or accumulate samples of rare respondents (Bijker 1995). Snowballing relies on the fact that people with rare interests or attributes tend to know others like themselves. Pyramiding modifies this idea by assuming that people with a strong interest in a topic or field can direct an enquiring researcher to people more expert than themselves. Experiments have shown that pyramiding can identify high-quality informants much more efficiently than can mass-screening techniques under many conditions (von Hippel, Franke, and Prügl 2005). Pyramiding was made into a practical industrial process by Mary Sonnack, a Division Scientist at 3M, and Joan Churchill, a psychologist specializing in the development of industrial training programs.

Identifying Lead Users in Target Markets

In general it is easier to identify users at the leading edge of target markets than it is to identify users in advanced analog fields. Screening for users with lead user characteristics can be used. When the desired type of lead user is so rare as to make screening impractical---often the case---pyramiding can be applied. In addition, manufacturers can take advantage of the fact that users at the leading edge of a target market often congregate at specialized sites or events that manufacturers can readily identify. At such sites, users may freely reveal what they have done and may learn from others about how to improve their own practices still further. Manufacturers interested in learning from these lead users can easily visit the sites and listen in. For example, sports equipment companies can go to sporting meets where lead users are known to compete, observe user innovations in action, and compare notes.

Essentially the same thing can be done at virtual sites. For example, recall the practices of StataCorp, a supplier of statistical software. Stata sells a set of standard statistical tests and also a language and tools that statisticians can use to design new tests to serve their own evolving needs. Some Stata users (statisticians) took the initiative to set up a few specialized websites, unaffiliated with StataCorp, where they post their innovations for others to download, use, comment on, and improve. StataCorp personnel visit these sites, learn about the user innovations, and observe which tests seem to be of interest to many users. They then develop proprietary versions of the more generally useful tests as commercial products.

When specialized rendezvous sites for lead users don't exist in a particular field, manufacturers may be able to create them. Technicon Corporation, for example, set up a series of seminars at which innovating users of their medical equipment got together and exchanged information on their innovations. Technicon engineers were free to listen in, and the innovations developed by these users were the sources of most of Technicon's important new product improvements (von Hippel and Finkelstein 1979).

The 3M Experiment

To test whether lead users in advanced analog fields can in fact generate information that leads to commercially valuable new products, Lilien, Morrison, Searls, Sonnack, and von Hippel (2002) studied a natural experiment at 3M. That firm was carrying out both lead user projects and traditional market research-based idea-generation projects in the same divisions at the same time, and in sufficient numbers to make statistical comparisons of outcomes possible.

Methods

3M first began using the lead user method in one division in 1996. By May 2000, when data collection began, five divisions of 3M had completed seven lead user (LU) idea-generation projects and had funded further development of the product concepts generated by five of these. These same five divisions also had 42 contemporaneously funded projects that used “find a need and fill it” idea-generation methodologies that were traditional practice at 3M. We used these two samples of funded ideas to compare the performance of lead user idea-generation projects with traditional idea-generation projects. Although 3M cooperated in the study and permitted access to company records and to members of the product-development teams, the firm did not offer a controlled experimental setting. Rather, we as researchers were required to account for any naturally occurring differences after the fact.

Our study methodology required a pre-post/test-control situation, with at least quasi-random assignments to treatment cells (Cook and Campbell 1979). In other words, our goal was to compare samples of development projects in 3M divisions that differed with respect to their use of lead user idea-generation methods, but that were as similar as possible in other respects. Identifying, understanding, and controlling for the many potential sources of difference that could affect the natural experiment involved careful field explorations. Thus, possible differences between project staffing and performance incentives applied to LU and non-LU idea-generation projects were assessed. We looked for (and did not find) differences in the capabilities or motivation of LU and non-LU project team members with respect to achieving a major new product advance. 3M managers also said that there was no difference in these matters, and a content analysis of formal annual performance goals set for the individual LU and non-LU team members in a division that allowed access to these data supported their views.

We also found no major differences in the innovation opportunities teams faced. They also looked for Hawthorne or placebo effects that might affect the project teams differentially, and found none. (The Hawthorne effect can be described as “I do better because extra attention is being paid to me or to my performance.” The placebo effect can be described as “I expect this process will work and will strive to get the results I have been told are likely.”) We concluded that the 3M samples of funded LU and non-LU idea-generation projects, though not satisfying the random assignment criterion for experimental design, appeared to satisfy rough equivalence criteria in test and control conditions associated with natural or quasi-experimentation. Data were collected by interviews and by survey instruments.

With respect to the intended difference under study---the use of lead user methods within projects---all lead user teams employed an identical lead user process taught to them with identical coaching materials and with coaching provided by members of the same small set of internal 3M coaches. Each lead user team consisted of three or four members of the marketing and technical departments of the 3M division conducting the project. Teams began by identifying important market trends. Then, they engaged in pyramiding to identify lead users with respect to each trend both within the target market and in advanced analog markets. Information from a number of innovating lead users was then combined by the team to create a new product concept and business plan---an “LU idea” (von Hippel, Thomke, and Sonnack 1999).

Non-lead-user idea-generation projects were conducted in accordance with traditional 3M practices. I refer to these as non-LU idea generation methods and to teams using them as non-LU teams. Non-LU teams were similar to lead user teams in terms of size and make-up. They used data sources for idea generation that varied from project to project. Market data collected by outside organizations were sometimes used, as were data from focus groups with major customers and from customer panels, and information from lab personnel. Non-LU teams collected market information from target markets users but not from lead users.

Findings

Our research compared all funded product concepts generated by LU and non-LU methods from February 1999 to May 2000 in each of the five 3M divisions that had funded one or more lead-user-developed product concepts. During that time, five ideas generated by lead user projects were being funded, along with 42 ideas generated by non-LU idea-generation methods. The results of these comparisons can be seen in table 10.1. Product concepts generated by seeking out and learning from lead users were found to be significantly more novel than those generated by non-LU methods. They were also found to address more original or newer customer needs, to have significantly higher market share, to have greater potential to develop into an entire product line, and to be more strategically important. The lead-user-developed product concepts also had projected annual sales in year 5 that were greater than those of ideas generated by non-LU methods by a factor of 8---an average of $146 million versus an average of $18 million in forecast annual sales. Thus, at 3M, lead user idea-generation projects clearly did generate new product concepts with much greater commercial potential than did traditional, non-LU methods (p < 0.005).

Table 10.1 Concepts for new products developed by lead user project teams had far more commercial promise than those developed by non-lead-user project teams.

| ~ | LU product concepts (n =5) | Non-LU product concepts (n = 42) | Significance |

|---|---|---|---|

| Factors related to value of concept | ~ | ~ | ~ |

| Novelty compared with competition a | 9.6 | 6.8 | 0.01 |

| Originality/newness of customer needs addressed | 8.3 | 5.3 | 0.09 |

| % market share in year 5 | 68% | 33% | 0.01 |

| Estimated sales in year 5 (deflated for forecast error) | $146m | $18m | 0.00 |

| Potential for entire product family a | 10.0 | 7.5 | 0.03 |

| Operating profit | 22% | 24.0% | 0.70 |

| Probability of success | 80% | 66% | 0.24 |

| Strategic importance a | 9.6 | 7.3 | 0.08 |

| Intellectual property protection a | 7.1 | 6.7 | 0.80 |

| Factors related to organizational fit of concept | ~ | ~ | ~ |

| Fit with existing distribution channels a | 8.8 | 8.0 | 0.61 |

| Fit with existing manufacturing capabilities a | 7.8 | 6.7 | 0.92 |

| Fit with existing strategic plan a | 9.8 | 8.4 | 0.24 |

Source: Lilien et al. 2002, table 1.

a. Rated on a scale from 1 to 10.

Note that the sales data for both the LU and non-LU projects are forecasts. To what extent can we rely on these? We explored this matter by collecting both forecast and actual sales data from five 3M division controllers. (Division controllers are responsible for authorizing new product-development investment expenditures.) We also obtained data from a 1995 internal study that compared 3M's sales forecasts with actual sales. We combined this information to develop a distribution of forecast errors for a number of 3M divisions, as well as overall forecast errors across the entire corporation. Those errors range from forecast/actual of +30 percent (over-forecast) to --13 percent (underforecast). On the basis of the information just described, and in consultation with 3M management, we deflated all sales forecast data by 25 percent. That deflator is consistent with 3M's historical experience and, we think, provides conservative sales forecasts.

Rather strikingly, all five of the funded 3M lead user projects created the basis for major new product lines for 3M (table 10.2). In contrast, 41 of 42 funded product concepts generated by non-LU methods were improvements or extensions of existing product lines (χ2 test, p < 0.005).

Following tt, p < 0.005).e advice of 3M divisional controllers, major product lines were defined as those separately reported in divisional financial statements. In 1999 in the 3M divisions we studied, sales of individual major product lines ranged from 7 percent to 73 percent of total divisional sales. The sales projections for funded lead user project ideas all fell well above the lower end of this range: projected sales five years after introduction for funded LU ideas, conservatively deflated as discussed above, ranged from 25 percent to over 300 percent of current total divisional sales.

Table 10.2 Lead user project teams developed concepts for major new product lines. Non-lead-user project teams developed concepts for incremental product improvements.

| ~ | Incremental product improvements | Major new product lines |

|---|---|---|

| LU method | 0 | 5 |

| Non-LU method | 41 | 1 |

Source: Lilien et al. 2002, table 2.

To illustrate what the major product line innovations that the LU process teams generated at 3M were like, I briefly describe four (one is not described for 3M proprietary reasons):

● A new approach to the prevention of infections associated with surgical operations. The new approach replaced the traditional “one size fits all” approach to infection prevention with a portfolio of patient-specific measures based on each patient's individual biological susceptibilities. This innovation involved new product lines plus related business and strategy innovations made by the team to bring this new approach to market successfully and profitably.

● Electronic test and communication equipment for telephone field repair workers that pioneered the inclusion of audio, video, and remote data access capabilities. These capabilities enabled physically isolated workers to carry out their problem-solving work as a virtual team with co-workers for the first time.

● A new approach, implemented via novel equipment, to the application of commercial graphics films that cut the time of application from 48 hours to less than 1 hour. (Commercial graphics films are used, for example, to cover entire truck trailers, buses, and other vehicles with advertising or decorative graphics.) The LU team's solutions involved technical innovations plus related channel and business model changes to help diffuse the innovation rapidly.

● A new approach to protecting fragile items in shipping cartons that replaces packaging materials such as foamed plastic. The new product lines implementing the approach were more environmentally friendly and much faster and more convenient for both shippers and package recipients than other products and methods on the market.

Lilien, Morrison, Searls, Sonnack, and I also explored to see whether the major product lines generated by the lead user projects had characteristics similar to those of the major product lines that had been developed at 3M in the past, including Scotch Tape. To determine this we collected data on all major new product lines introduced to the market between 1950 and 2000 by the five 3M divisions that had executed one or more lead user studies. (The year 1950 was as far back as we could go and still find company employees who could provide some data about the innovation histories of these major products lines.) Examples from our 1950--2000 sample include the following:

● Scotch Tape: A line of transparent mending tapes that was first of its type and a major success in many household and commercial applications.

● Disposable patient drapes for operating room use: A pioneering line of disposable products for the medical field now sold in many variations.

● Box sealing tapes: The first type of tape strong enough to reliably seal corrugated shipping boxes, it replaced stapling in most “corrugated shipper” applications.

● Commercial graphics films: Plastic films capable of withstanding outdoor environments that could be printed upon and adhered to large surfaces on vehicles such as the sides of trailer trucks. This product line changed the entire approach to outdoor signage.

Table 10.3 provides profiles of the five LU major product lines and the 16 non-LU major product lines for which we were able to collect data. As can be seen, innovations generated with inputs from lead users are similar in many ways to the major innovations developed by 3M in the past.

Table 10.3 Major new product lines (MNPLs) generated by lead-user methods are similar to MNPLs generated by 3M in the past.

| ~ | LU MNPLs (n = 5) | Past 3M MNPLs (n = 16) | Significance |

|---|---|---|---|

| Novelty a compared with competition | 9.6 | 8.0 | 0.21 |

| Originality/newness of customer needs addresseda | 8.3 | 7.9 | 0.78 |

| % market share in year 5 | 68% | 61% | 0.76 |

| Estimated sales in year 5 (deflated for forecast error) | 146mb | $62mb | 0.04 |

| Potential for entire product familya | 10.0 | 9.4 | 0.38 |

| Operating profit | 22% | 27% | 0.41 |

| Probability of success | 80% | 87% | 0.35 |

| Strategic importance* | 9.6 | 8.5 | 0.39 |

| Intellectual property protectiona | 7.1 | 7.4 | 0.81 |

| Fit with distribution channelsa | 8.8 | 8.4 | 0.77 |

| Fit with manufacturing capabilitiesa | 7.8 | 6.7 | 0.53 |

| Fit with strategic plana | 9.8 | 8.7 | 0.32 |

Source: Lilien et al. 2002, table 4.

a. Measured on a scale from 1 to 10.

b. Five-year sales forecasts for all major product lines commercialized in 1994 or later (5 LU and 2 non-LU major product lines) have been deflated by 25% in line with 3M historical forecast error experience (see text). Five-year sales figures for major product lines commercialized before 1994 are actual historical sales data. This data has been converted to 1999 dollars using the Consumer Price Index from the Economic Report of the President (Council of Economic Advisors 2000).

Discussion

The performance comparison between lead user and “find a need and fill it” idea-generation projects at 3M showed remarkably strong advantages associated with searching for ideas among lead users in advanced analog fields with needs similar to, but even more extreme than, needs encountered in the intended target market. The direction of this outcome is supported by findings from three other real-world industrial applications of lead user idea-generation methods that studied lead users in the target market but not in advanced analog markets. I briefly describe these three studies next. They each appear to have generated primarily next-generation products--- valuable for firms, but not the basis for radically new major product lines.

%%

● Recall that Urban and von Hippel (1988) tested the relative commercial attractiveness of product concepts developed in the field of computer-aided systems for the design of printed circuit boards (PC-CAD). One of the concepts they tested contained novel features proposed by lead users that had innovated in the PC-CAD field in order to serve in-house need. The attractiveness of the “lead user concept” was then evaluated by a sample of 173 target-market users of PC-CAD systems relative to three other concept choices---one of which was a description of the best system then commercially available. Over 80 percent of the target-market users were found to prefer the concept incorporating the features developed by innovating lead users. Their reported purchase probability for a PC-CAD system incorporating the lead user features was 51 percent, over twice as high as the purchase probability indicated for any other system. The target-market users were also found willing to pay twice as much for a product embodying the lead user features than for PC-CAD products that did not incorporate them.

● Herstatt and von Hippel (1992) documented a lead user project seeking to develop a new line of pipe hangers---hardware used to attach pipes to the ceilings of commercial buildings. Hilti, a major manufacturer of construction-related equipment and products, conducted the project. The firm introduced a new line of pipe hanger products based on the lead user concept and a post-study evaluation has shown that this line has become a major commercial success for Hilti.

● Olson and Bakke (2001) report on two lead user studies carried out by Cinet, a leading IT systems integrator in Norway, for the firm's two major product areas, desktop personal computers, and Symfoni application GroupWare. These projects were very successful, with most of the ideas incorporated into next-generation products having been collected from lead users.

Active search for lead users that have innovated enables manufacturers to more rapidly commercialize lead user innovations. One might think that an alternative approach would be to identify lead users before they have innovated. Alert manufacturers could then make some prior arrangements to get preferred access to promising user-developed innovations by, for example, purchasing promising lead user organizations. I myself think that such vertical integration approaches are not practical. As was shown earlier, the character and attractiveness of innovations lead users may develop is based in part on the particular situations faced by and information stocks held by individual lead users. User innovation is therefore likely to be a widely distributed phenomenon, and it would be difficult to predict in advance which users are most likely to develop very valuable innovations.

How do we square these findings with the arguments, put forth by Christensen (1997), by Slater and Narver (1998), and by others, that firms are likely to miss radical or disruptive innovations if they pay close attention to requests from their customers? Christensen (1997, p. 59, n. 21) writes: “The research of Eric von Hippel, frequently cited as evidence of the value of listening to customers, indicates that customers originate a large majority of new product ideas. . . . The [Christensen] value network framework would predict that the innovations toward which the customers in von Hippel's study led their suppliers would have been sustaining innovations. We would expect disruptive innovations to have come from other sources.”

Unfortunately, the above contains a basic misunderstanding of my research findings. My findings, and related findings by others as well, deal with innovations by lead users, not customers, and lead users are a much broader category than customers of a specific firm. Lead users that generate innovations of interest to manufacturers can reside, as we have seen, at the leading edges of target markets, and also in advanced analog markets. The innovations that some lead users develop are certainly disruptive from the viewpoint of some manufacturers---but the lead users are unlikely to care about this. After all, they are developing products to serve their own needs. Tim Berners-Lee, for example, developed the World Wide Web as a lead user working at CERN---a user of that software. The World Wide Web was certainly disruptive to the business models of many firms, but this was not Berners-Lee's concern. Lead users typically have no reason to lead, mislead, or even contact manufacturers that might eventually benefit from or be disrupted by their innovations. Indeed, the likely absence of a preexisting customer relationship is the reason that manufacturing firms must search for lead user innovations outside their customer lists---as 3M did in its lead user idea generation studies. “Listening to the voice of the customer” is not the same thing as seeking out and learning from lead users (Danneels 2004).

That basic misunderstanding aside, I do agree with Christensen and others that a manufacturer may well receive mainly requests for sustaining innovations from its customers. As was discussed in chapter 4, manufacturers have an incentive to develop innovations that utilize their existing capabilities---that are “sustaining” for them. Customers know this and, when considering switching to a new technology, are unlikely to request it from a manufacturer that would consider it to be disruptive: they know that such a manufacturer is unlikely to respond positively. The net result is that manufacturers' inputs from their existing customers may indeed be biased towards requests for sustaining innovations.

I conclude this chapter by reminding the reader that studies of the sources of innovation show clearly that users will tend to develop some types of innovations but not all. It therefore makes sense for manufacturers to partition their product-development strategies and portfolios accordingly. They may wish, for example, to move away from actual new product development and search for lead users' innovations in the case of functionally novel products. At the same time manufacturers may decide to continue to develop products that do not require high-fidelity models of need information and use environments to get right. One notable category of innovations with this characteristic is dimension-of-merit improvements to existing products. Sometimes users state their needs for improved products in terms of dimensions on which improvements are desired---dimensions of merit. As an example, consider that users may say “I want a computer that is as fast and cheap as possible.” Similarly, users of medical imaging equipment may say “I want an image that is of as high a resolution as is technically possible.” If manufacturers (or users) cannot get to the end point desired by these users right away, they will instead progressively introduce new product generations that move along the dimension of merit as rapidly and well as they can. Their rate of progress is determined by the rate at which solution technologies improve over time. This means that sticky solution information rather than sticky need information is central to development of dimension-of-merit improvements. Manufacturers will tend to have the information they need to develop dimension of merit innovations internally.

Copyright: 2005 Eric von Hippel. Exclusive rights to publish and sell this book in print form in English are licensed to The MIT Press. All other rights are reserved by the author. An electronic version of this book is available under a Creative Commons license.

≅ SiSU Spine ፨ (object numbering & object search)

(web 1993, object numbering 1997, object search 2002 ...) 2024